Ready for More Room? How to Move Up in the St. Louis Real Estate Market

Ready for More Room? How to Move Up in the St. Louis Real Estate Market

Are you ready to upgrade to a larger home in the St. Louis area? Moving up is an exciting step that can bring more space, better amenities, or a new neighborhood into your life. However, it comes with its own set of challenges and considerations. Here’s what you need to know to navigate the process smoothly and make informed decisions.

1. Why Move Up?

Moving to a bigger home can significantly enhance your quality of life. Perhaps your family is growing, and you need more bedrooms or a bigger yard. Or maybe you’re seeking a neighborhood closer to top-rated schools or your workplace in St. Louis. For example, families in South County often look for homes with larger backyards, while those in Northern Jefferson County may prioritize proximity to parks and recreational facilities.

2. Do I Have Enough Equity and Savings to Move Up?

Tip: Start by reviewing your mortgage statement to understand your equity. Online calculators can give you an estimate of your home’s value, but a consultation with a Realtor will provide a more accurate figure. For instance, if you’ve lived in your home for several years, you may have built substantial equity that can be used as a down payment for your new home. Also, ensure you have enough savings to cover moving expenses, closing costs, and any unexpected fees.

3. Should I Sell Before Buying or Buy Before Selling?

Tip: This decision often depends on your financial situation and the market conditions. Selling first can help you clearly define your budget for the next home, but it also means you might need temporary housing. On the other hand, buying first ensures you have a place to move into immediately. In a competitive market like St. Louis, it might be beneficial to secure your next home first to avoid settling for less desirable options.

4. Should I Sell On My Own or Hire a Professional?

Tip: Selling a home involves marketing, negotiations, and legal paperwork. For example, a Realtor can help you set the right price for your home based on recent sales in your St. Louis neighborhood, ensuring you get the best deal. Their expertise can streamline the process and help you avoid common mistakes, such as overpricing your property or missing critical deadlines.

5. Should I Buy On My Own or Hire a Professional?

Tip: A buyer’s agent can be invaluable when purchasing a home. They have access to the latest listings and can help you find properties that meet your criteria in the St. Louis market. For instance, they can provide insights into neighborhood trends, school ratings, and commute times, saving you time and effort in your search.

6. What Pitfalls Should I Watch Out For?

Tip: Be cautious of overestimating your budget or underestimating moving costs. Getting pre-approved for a mortgage can clarify your buying power. Always schedule a thorough home inspection to uncover potential issues before finalizing the purchase. Consider future costs like maintenance, property taxes, and utility bills in your new home.

Additional Tips for First-Time Move-Up Buyers:

- Get Pre-Approved: Secure a mortgage pre-approval to understand your buying power and streamline the buying process.

- Research Neighborhoods: Explore different areas in St. Louis to find the best fit for your lifestyle and needs.

- Plan for Overlapping Costs: Be prepared for potential overlap in mortgage payments if you buy before selling.

- Stay Flexible: The process can be unpredictable, so maintain flexibility with your timeline and expectations.

- Work with Trusted Professionals: From real estate agents to inspectors, having a reliable team can make all the difference.

Ready to make your move in the St. Louis market? Contact a trusted real estate professional today to get started on your journey to a new home! 🏡✨

For additional information watch my video on YouTube “Shopping For A New Home“

Moving Tips for Empty Nesters: Simplify Your Transition to a Smaller Home

As an empty nester, transitioning to a smaller home can be both exciting and daunting. Downsizing offers a chance to simplify your life, reduce expenses, and embrace a new chapter. Here are some essential tips to help you navigate this transition smoothly.

- Should I Downsize My Home?

Deciding whether to downsize is a personal choice that depends on various factors. Here are some considerations to help you decide:

- Lifestyle Changes: With children out of the house, you may no longer need as much space. A smaller home can be easier to maintain and more suited to your current lifestyle.

- Financial Benefits: Downsizing can free up equity tied up in your home, providing funds for retirement, travel, or other pursuits.

- Location Preferences: Moving to a smaller home might allow you to relocate to a more desirable area, closer to amenities, family, or friends.

- Emotional Readiness: Consider if you are emotionally ready to leave a home filled with memories. It’s important to be prepared for this change.

- What Will It Cost to Downsize?

Understanding the costs involved in downsizing is crucial for planning. Here are some expenses to consider:

- Moving Costs: Hiring movers, renting a truck, or purchasing packing supplies can add up. Get quotes from multiple moving companies to find the best deal.

- Renovation and Repairs: Your current home may need some updates or repairs before selling. Similarly, your new home might require modifications to suit your needs.

- Real Estate Fees: If you hire a real estate seller’s agent, factor in their commission fees. These typically range from 3 -4% of the sale price. There may additional buyer agent fees which typically range from 2.5- 3%. FYI – both buyer and seller agent fees are negotiable.

- Closing Costs: Both selling your current home and purchasing a new one come with closing costs, including title insurance, appraisal fees, and legal fees to name a few.

- What Cost Savings Will There Be After Downsizing?

Downsizing can lead to significant cost savings, making it a financially savvy decision. Here are some potential savings:

- Lower Mortgage Payments: A smaller home often means a smaller mortgage, reducing your monthly payments.

- Reduced Utility Bills: Less space to heat, cool, and light can lead to lower utility bills.

- Maintenance Savings: A smaller home typically requires less maintenance, saving you time and money on repairs and upkeep.

- Property Taxes: Smaller homes usually come with lower property taxes, providing additional savings.

- Should I Sell Before I Buy or Buy a New Home Before I Sell?

Deciding whether to sell your current home before buying a new one depends on your financial situation and market conditions. Here are some pros and cons of each option:

- Sell Before Buying:

- Pros: You’ll know exactly how much money you have to spend on your new home, and you won’t have to carry two mortgages.

- Cons: You may need temporary housing if you can’t find a new home immediately after selling. Which may mean finding and paying for storage.

- Buy Before Selling:

- Pros: You can move at your own pace and avoid the stress of finding a new home quickly.

- Cons: You may need to qualify for two mortgages simultaneously, which can be financially challenging.

- Should I Sell as a For Sale By Owner or Hire a Professional Agent?

Choosing between selling your home yourself or hiring a professional agent depends on your comfort level and expertise in real estate transactions. Here are some points to consider:

- For Sale By Owner (FSBO):

- Pros: You can save on Seller agent commission fees. However, the buyer may bring their own agent whose fees may be negotiated into the sale contract.

- Cons: Selling a home requires significant time, effort, and knowledge of the real estate market. You may also have limited access to marketing resources.

- Hiring a Professional Agent:

- Pros: An experienced agent can handle all aspects of the sale, from pricing and marketing to negotiations and paperwork. They can also provide valuable market insights and access to a broader pool of potential buyers.

- Cons: You’ll need to pay a Seller’s agent commission fee, typically around 3-4% of the sale price and maybe, depending on how your sale contract is written a Buyer’s agent commission fee, typically around 2-3%

Conclusion

Downsizing as an empty nester can be a rewarding experience, offering financial benefits and a simpler lifestyle. By carefully considering your options and planning ahead, you can make a smooth transition to a smaller home. Whether you choose to sell before buying, hire a professional agent, or go the FSBO route, these tips will help you navigate the process with confidence.

If you’re in the St. Louis real estate market and considering downsizing, these insights will guide you through the journey. For Additional Insights into downsizing your home, check out my YouTube Channel at https://www.youtube.com/@heybobstl

Happy moving!

Why a Growing Family Should Consider Home Upsizing

Why a Growing Family Should Consider Home Upsizing

Introduction

The decision in home upsizing is a critical moment for growing families. This is marked by a number of considerations that extend beyond the number of bedrooms and bathrooms in a home. In this article, we explore some factors that should guide the decision-making process. While providing insights for families navigating the ever-changing landscape of residential real estate.

Embarking on the journey of upsizing a home is not merely about expanding living space; it’s a strategic move connected with a family’s objectives and needs. As the dynamics of a family evolve, so do the criteria for the ideal living space. In this exploration, we shed light on why a growing family should contemplate upsizing and the crucial factors that should guide this life changing decision.

Factors Influencing the Decision In Home Upsizing

-

Schools and Educational Opportunities

In the quest for an ideal residence, the proximity and quality of schools play a pivotal role. Families with school-going children must carefully consider the impact of their chosen neighborhood on the educational journey of their children. Beyond the home itself, the surrounding educational landscape contributes to the overall growth and development of children.

-

Job Opportunities and Commute

As careers advance and job locations shift, the daily commute becomes a vital consideration for families. Choosing a home purposefully aligned with job opportunities not only reduces commuting stress but also fosters a balance between professional growth and family life. Depending on your employment, you may have the opportunity to work from home. If so would you need a dedicated home office or workspace to conduct your job?

-

Neighborhood Growth or Decline

The neighborhood’s overall economic path can influence the decision to upsize. Analyzing current trends and future projections provides valuable insights into property values and the overall desirability of a location. A thriving community can enhance the quality of life for a growing family, making it a key factor in the decision-making process. This should be considered for both the neighborhood you are considering leaving and the one you may move to.

Timing: Should I Sell or Buy First When Home Upsizing?

-

Selling First

Opting to sell the current home before purchasing a new one comes with its own set of advantages. Financially, it provides a clearer picture, avoiding the complexities of managing two mortgages simultaneously. Additionally, knowing the sale of your existing is completed can simplify the process of negotiating for the new home. Many home sellers may consider your offer to buy when you don’t have a home to sell over those that do.

-

Buying First

On the flip side, some families may find it advantageous to secure a new home before selling the existing one. This approach offers the comfort of having a designated space lined up, reducing the potential stress of having to make a double move. However, it comes with the challenge of managing two properties simultaneously and the uncertainties associated with selling the current home.

What Are Mortgage Considerations?

-

Managing Existing Mortgage

Effectively managing an existing mortgage is a crucial aspect of the upsizing process. Options such as refinancing or bridge loans can provide financial flexibility, allowing families to navigate the transition smoothly.

-

Obtaining a Mortgage for the New Home

Securing a mortgage for an upsized property involves a distinct set of considerations. Understanding the approval process, credit requirements, and interest rates is essential for a seamless transition to a new home. Working closely with a knowledgeable mortgage advisor can streamline this process.

Working with a Real Estate Agent

Choosing the right real estate agent is like having a trusted navigator in uncharted waters. An experienced agent not only understands the local market conditions but also customizes the search to align with the unique needs of a growing family. Collaborating with an agent from the outset can simplify the upsizing journey.

Additionally, the agent should be able to tell you what type of market you are selling and or buying in. Is it a sellers’ market? Homes here sell quickly for close to or above asking price with few contingencies. Is it a balanced market? In this market buyers and sellers have a little give and take on the negotiation. Or is it a buyer’s market? Here a lot of homes on the market and buyers control the sale price and terms.

Other Key Considerations in Home Upsizing

-

Future Planning

Upsizing is not merely a response to current needs but a strategic move considering future family dynamics. Families should contemplate long-term plans, ensuring the chosen home accommodates potential changes in family size or structure.

-

Home Features and Amenities

Beyond the logistical aspects, families should tailor their search to homes that resonate with their lifestyle. Assessing desired features, amenities, and the overall ambiance ensures the new home is not just a residence but a sanctuary that enhances the family’s daily life.

Conclusion

In conclusion, the decision to upsize a home for a growing family is a nuanced process that extends beyond the physical dimensions of a property. It involves a delicate balance of practical considerations, future planning, and aligning the home with the evolving needs of the family. By navigating these considerations thoughtfully, families can embark on the next chapter of their lives with confidence and anticipation.

For more information on the home selling and buying process, choose from one (or both) of these guides.

Home Buyer’s Guide for 2024 and beyond Or Home Seller’s Guide for 2024 and beyond

How to Downsize Your Home

How To Downsize Your Home

Thinking of moving to a new, smaller home? What are your reasons to move? Have you considered your reasons to move? What reasons would there be to move? Well, stay tuned we are going to discuss how to downsize your home, right after this

Hi, I’m Bob Weibrecht a Licensed Realtor with Coldwell Banker Realty – Gundaker in St. Louis, MO. If you are interested in all things residential real estate, please follow

Now onto the reason why you stopped by, and that is Nine Considerations on How to Downsize Your Home

There are plenty of reasons to downsize to a smaller home. Such as you have found yourself an empty-nester. You are not happy with the location. You wish to be closer to family and friends. Your home just no longer fits your lifestyle. You are tired of never-ending house maintenance, yard maintenance, increasing utility costs, increasing real estate taxes and increasing homeowners’ insurance.

Any one or more of these can be a valid reason to downsize your home. You want a more relaxed lifestyle to come and go and to do as you please. Who could fault you for that?

Your decision to downsize may have benefits you have not even thought of, such as more time for desired activities, lower utility cost, reduced home expenses, reduced home and yard maintenance, reduced real estate taxes and reduced homeowner’s insurance.

This implies more money can be put into your pocket which in turn in to savings and investing accounts which may mean early retirement and taking off on an RV adventure! Sounds like a lot of fun.

Whatever your reasons for downsizing, it can be an emotional decision and process. All the family memories you will leave behind, the friendly neighbors and so much more. It helps to take an objective look at nine things when considering downsizing.

Here are nine things to consider in how to downsize your home.

- Your Plans

Consider your future. Do you plan to retire and make a smaller home your forever home? If so, think about the accommodations for you and people living with you. For instance, a home with stairs may be an obstacle for elderly person or a person with mobility concerns.

What about laundry facilities? Do you want washer and dryer on the main floor or in the basement? If you are going to rent, does the home, apartment building or condo complex have an elevator or is it stairs? Consider nearby amenities such as shopping, recreation, major roads etc. You will need to leave your new home sometime if nothing more than for essentials

- Your Household

How many people will be living with you? Do you have a significant other? Will there be children living with you? This is truly the measure of how small you can buy. After all, moving a large family into a small two-bedroom home is not practical and may be illegal in some areas. Check with local regulations in the areas you are thinking of moving to.

- Your Personal space

How much personal space do you need? What do you like to do in your spare time?

Do you prefer to be around others for social interaction such as a close-knit neighborhood with lots of families or is solitude and alone time what you are looking for in a rural location far, far away from others?

What about hobbies? Some hobbies such as model railroading or woodworking can take up a lot of space while gaming or puzzle assemble can take up little room. Be sure to consider YOUR personal space before committing to downsizing, not just those of your household requirements

- Your Home Office

Are you and or your significant other employed? Can you work from home instead of commuting to work? Do either have a side hustle for extra income? Consider the current and potential future requirements of the income source to plan accordingly.

To generate income, you may need a private room, or an area closed off from the rest of the home where you can concentrate on the task at hand. That home with the large storage shed with utilities may be looking pretty good about now.

- Desired Amenities

Think about the amenities with your current home. Do you have a pool or does the subdivision have one? Are there any recreational facilities you might miss such as club house or tennis court? Is your yard fenced for your dog? Keep your pets in mind during this time.

Check out activities in the neighborhoods you are considering. Remember a smaller home may encourage you to get out more. Having activities to look forward to will increase your enjoyment and satisfaction of deciding to downsize.

- Your Neighbors

How close do you want to be to new neighbors? A few feet away in the next home, apartment, or condo so you can share their love of music or an acre or more away where you can barely see their home? This is an important consideration for yourself to decide.

- Guest Space

Guests may be invited or a welcome surprise. This could be a major consideration in downsizing to a smaller home. How frequently do you expect guests? What’s the maximum number of guests at once? What’s the expected duration of their stay? Any specific preferences for their activities during their stay?

Think about your desired area to move to, does it have motel or hotel nearby to refer guest to if necessary? Are there any rental properties such as AirBnB or VRBO nearby?

If your downsizing plans include moving to a popular area such as a recreation or resort area. You may have more guests than you realize, just saying… so you may wish to factor in room and bath for guest accommodations.

- Decluttering Vs Storage

Moving to a smaller home means… less space. Consider where are you going to put your stuff? Does your smaller home have an attic, basement, garage, storage shed etc.?

What about that fishing boat or RV? Do you have a work vehicle? Check with the home’s homeowner association about their rules for parking such vehicles in your driveway. Hint – Do this before you are obligated to buy your next home!

If there is not enough storage and the homeowner association’s rules prohibit you from storing recreational or even work vehicles in your driveway. Are you going to rent storage space or let go of stuff? One will cost you money over time the other may make you a little money. Which will it be? AND NUMBER 9

- Appliances and Furniture

Regarding appliances did you know that in the St. Louis Realtors real estate contracts, the kitchen stove, built in microwave, dishwasher, garbage disposal remain with the home after the sale unless otherwise specified and agreed to in the contract by the buyer and seller

The refrigerator, washer and dryer and small countertop appliances are considered personal property and can be taken when you move. Unless… you guessed it is specified and agreed to in the contract. So, do you plan to take any kitchen appliances, the washer and dryer with you and if so, is there room in your smaller home for them? If not, they could be left in the home if the buyer agrees, sold, or donated?

What about your furniture? Will it fit in the smaller home? You may need to buy smaller furniture for your smaller home. Photographs can make rooms appear larger than what they actually are. Meaning that large, overstuffed sectional and huge eight-person dining room set may not fit where you want it to. If this is the case, then you will likely need furniture to fit the available space.

Psst, It is my goal to give value first. As a reward to you, yes you for watching. Here is a bonus consideration… By the way, don’t tell those who left. It’s their loss.

- Your Financial Goals

Finally, what about your long-term financial goals? Will downsizing to a smaller home help with your personal financial goals? For many homeowners, downsizing to save money is an important incentives in moving to a smaller home. There are many financial reasons to downsize, save for education of a child, save for retirement, save for just about anything.

Many people are simply look for ways to stretch their dollar. So, what are your financial goals and how are they related to your downsizing move? Question – would that extra guest room mentioned in #7 work out for an AirBnB or Vrbo for extra income???

If downsizing is in your future whether next month or several years away, make plans sooner than later. Your future self will thank you when you are enjoying life in your smaller, uncluttered downsized home.

Know you have valuable information to consider in downsizing your home. As they say on TV But Wait There’s More! Click on the video in the corner to learn more about the home buying and selling process and remember to subscribe and click that bell icon. I’ll see you next time

Make it a Great Day!

Bob Weibrecht, Licensed Realtor®

Coldwell Banker Realty – Gundaker

9964 Kennerly Center, St. Louis, MO

Contact me today at Contact Me (bobweibrecht.com)

For More Information About Selling your home. Click Below For These FREE Guides.

- How To Prepare Your House For Sale: https://bestrealestateblog.com/get-preparing-booklet/cKQLYQvxlMcyzocwSyDJ/69668

- The Ultimate Home Seller’s Guide: https://bestrealestateblog.com/get-home-sellers-guide/cKQLYQvxlMcyzocwSyDJ/382626

Visit me at www.HeyBobStL.com or https://www.facebook.com/HeyBobStL

See what is on the market at Rightsize Your Home (bobweibrecht.com)

Disclaimer:

Information provided in this vlog, video or blog post is meant to be used for educational purposes only, not financial, or legal advice. If you need help assistance with your real estate transactions, We always encourages you to consult your own advisor to resolve these issues.

Don’t have one? let me know and I will help you find a real estate professional in your area. Send request to Info@HeyBobStL.com with subject: Real Estate Professional needed.

Please include your name, email address and phone number in the body of the email. Tell me where you’re located, whether you’re buying, selling or both. I will help you find a qualified real estate professional quickly.

Podcast: Play in new window | Download

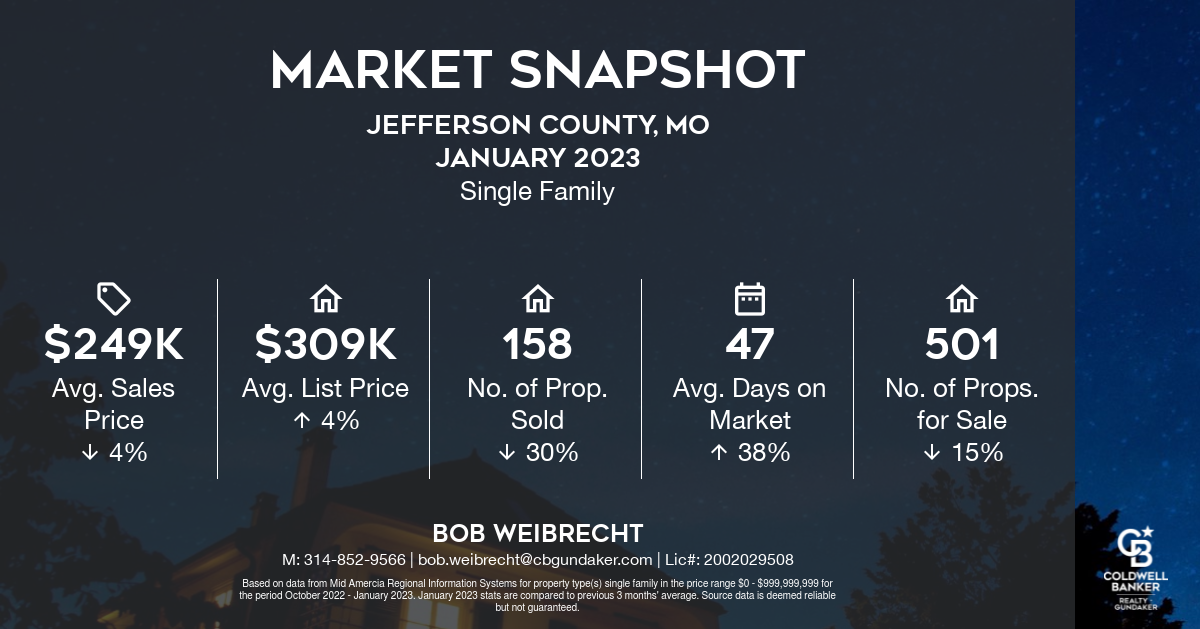

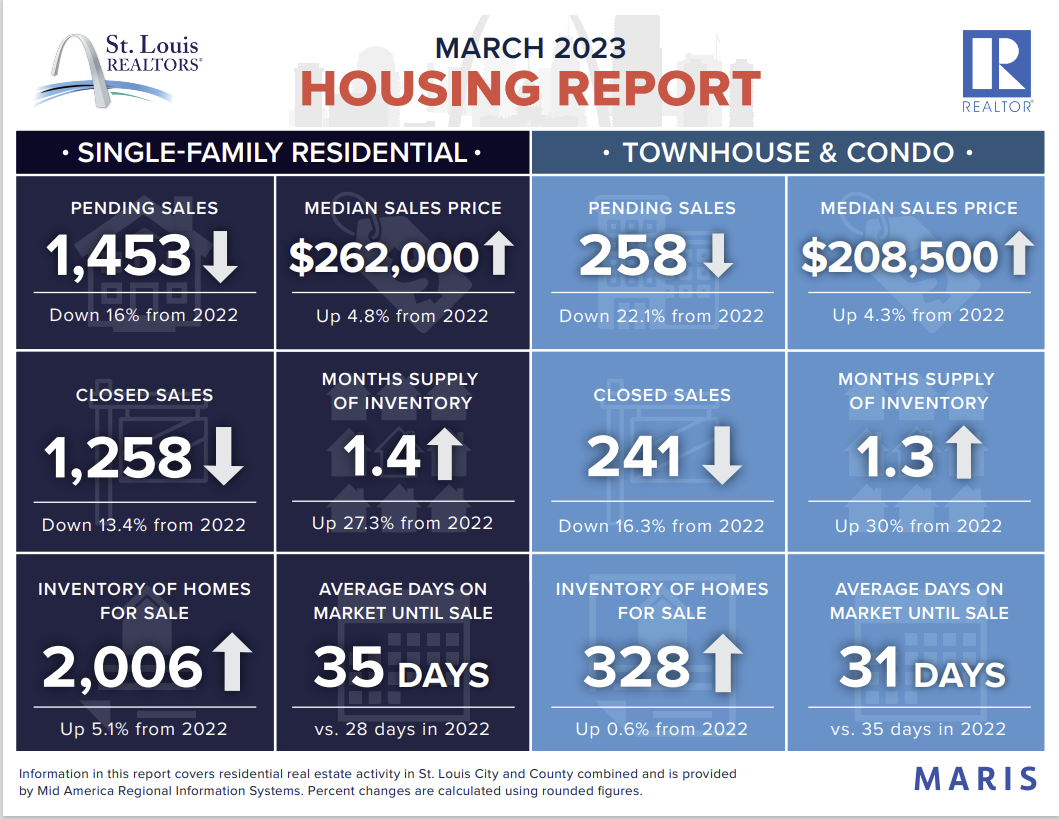

March 2023 St. Louis City and County Housing Report from the St. Louis Realtors

March 2023 St Louis Realtors Infographic on residential housing market

Information in this report covers residential real estate activity in St. Louis City and County combined and is provided by Mid America Regional Information Systems (MARIS). Percent changes are calculated using rounded figures.

Nationally, existing home sales jumped 14.5% month-over-month as of the last measure, the first monthly gain in 12 months, and representing the largest monthly increase since July 2020, according to the National Association of REALTORS® (NAR). The sudden uptick in sales activity stems from contracts signed toward the beginning of the year, when mortgage rates dipped to the low 6% range, causing a surge in homebuyer activity. Pending sales have continued to improve heading into spring, increasing for the third consecutive month, according to NAR.

New listings decreased by 13.4% for residential homes and 12.4% for townhouse/condo homes. Pending sales decreased by 16% for residential homes and 22.1% for townhouse/condo homes. Inventory increased by 5.1% for residential homes and 0.6% for townhouse/condo homes.

Median sales price increased 4.8% to $262,000 for residential homes and 4.3% to $208,500 for townhouse/condo homes. Days on market increased by 25% for residential homes but decreased by 11.4% for townhouse/condo homes. Months supply of inventory increased by 27.3% for residential homes and 30% for townhouse/condo homes.

Monthly sales might have been even higher if not for limited inventory nationwide. At the current sales pace, there was just 2.6 months’ supply of existing homes at the beginning of March, far below the 4-6 months’ supply of a balanced market. Inventory remains suppressed in part because of mortgage interest rates, which nearly hit 7% before falling again in recent weeks. Higher rates have continued to put downward pressure on sales prices, and for the first time in more than a decade, national home prices were lower year-over-year, according to NAR, breaking a 131-month streak of annual price increases.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link